The influence of stakeholders cannot be underestimated. Nor can it be left to play out on its own. Some individual stakeholders will be an immense source of opportunity; others, a worrisome source of risk. Still others may straddle the fence or even switch sides over time. It’s essential to understand the views, concerns and potential impacts of stakeholders on your project. Failing to do so could prevent its timely progress.

This is where proactive risk management comes in as part of a well-planned stakeholder management strategy.

What is stakeholder risk management?

Stakeholder risk management is the process of managing the risk that a stakeholder could negatively impact a project or business decision, or be negatively impacted by the project or decision. Stakeholder risks are prioritized by probability and potential impact. Risks posing the greatest threats warrant the most attention. Managing stakeholder risk is crucial for maintaining trust, ensuring successful project outcomes, and achieving organizational objectives.

Stakeholder risk management allows stakeholder management teams to answer five vital questions:

- Who cares about the project?

- What exactly do they care about?

- What are they likely to do about it?

- How could this impact the project’s progress?

- What are we going to do about it?

What types of risks can be associated with stakeholders?

1. Lack of support or commitment

Inadequate sponsorship: If the project lacks a strong sponsor, it may not receive the necessary resources, attention, or priority within the organization.

Low engagement: Stakeholders who are not adequately engaged may not provide timely or accurate information, leading to delays or missteps.

2. Resistance to change

Opposition: Some stakeholders may be resistant to the changes the project is implementing, potentially slowing progress or actively undermining the project.

Conflict: Different stakeholders may have conflicting interests or goals, leading to disputes that can derail the project.

3. Communication challenges

Miscommunication: Poor communication can lead to misunderstandings, misaligned expectations, and a lack of clarity about project goals and responsibilities.

Information overload: Too much information, or information that is not well-targeted, can overwhelm stakeholders and reduce their ability to effectively contribute to the project.

4. Scope creep

Changing requirements: Stakeholders might request additional features or changes after the project has started, leading to scope creep and potential delays.

Unclear objectives: If stakeholders have not clearly defined what they want from the project, it can lead to scope ambiguity and challenges in meeting expectations.

5. Competing priorities

Resource allocation: Stakeholders may have competing priorities for limited resources, leading to conflicts and potential project delays.

Time constraints: Stakeholders’ availability might be limited due to other commitments, reducing their ability to contribute to the project.

6. Legal and compliance risks

Non-compliance: Stakeholders may not be aware of or may neglect legal and regulatory requirements, putting the project at risk of non-compliance.

Contractual issues: Conflicts can arise if there are misunderstandings or disagreements regarding contractual obligations among stakeholders.

7. Financial risks

Budget overruns: Stakeholders might have unrealistic expectations regarding the budget, leading to overspending.

Funding instability: The project’s funding could be at risk if stakeholders withdraw their support or if there are changes in financial backing.

8. Lack of expertise

Inadequate skills: If stakeholders do not have the necessary skills or knowledge, it can hinder the project’s progress.

Dependence on key individuals: The project might be overly reliant on a few key stakeholders, posing a risk if they are unavailable.

9. Ethical concerns

Conflicts of interest: Stakeholders might have personal or professional interests that conflict with the project’s objectives.

Lack of transparency: If stakeholders are not transparent about their intentions or interests, it can lead to mistrust and project instability.

10. External factors

Market changes: Changes in the market or industry can impact stakeholders’ support or involvement in the project.

Political and social factors: Political and social issues can influence stakeholders’ perceptions and commitment to the project.

Stakeholder risk example

Below is an example of how stakeholder risk has played out in the energy sector.

The Dakota Access Pipeline is a 1,172-mile-long underground oil pipeline transporting crude oil from the Bakken shale oil fields in North Dakota to a terminal in Illinois.

During its construction, the project faced significant opposition from Native American tribes, particularly the Standing Rock Sioux Tribe, as well as environmental activists and other supporters. The primary concerns were potential harm to water supplies, as the pipeline crosses the Missouri River, and the destruction of sacred tribal lands and cultural sites.

This opposition to the project had serious consequences for the project and the companies behind it. Among them:

Delays and increased costs

Reputational damage

Regulatory and legal challenges

Impact on future projects

Why is stakeholder risk management important?

Good stakeholder risk management can increase the likelihood of securing social acceptance for a project and minimizing negative impacts on stakeholders. The opposite also holds true.

Simply identifying a project’s risks is not enough to mitigate their impacts. Since risks are always linked to one or more stakeholder groups – who may be directly or indirectly influencing or influenced by these risks, the bigger a risk to a project’s outcome, the more closely the associated stakeholder groups must be managed.

In turn, managing stakeholders productively requires careful and meaningful engagement with them. Teams must demonstrate a willingness to build long-term relationships based on mutual understanding, trust and compromise – often through two-way dialogue and consultation.

When done effectively, engagement tells the stakeholder:

- We’re willing to take the time to understand how you’re affected by the project.

- We’re willing to take the time to find out what you care most about.

- We’re willing to take the time to work with you to ensure acceptable outcomes.

Stakeholders are much more likely to support a project if they feel that the people behind it have taken the time to listen, understand and address their questions and concerns. Winning stakeholder support is the ultimate goal of risk management.

The journey to stakeholder support can be smooth sailing or a long, painful ride for teams. This will depend on the project itself, the stakeholder landscape, and the tools being used to manage aspects such as community relations and government affairs & public relations.

Stakeholder risk management framework

Since both the project and stakeholder landscape may change over time, stakeholder risk must be managed across the entire project lifecycle. A prerequisite to knowing where project stakeholders stand is to first identify who these stakeholders are and where they are located. You need to know what they care about, to what degree, and why. It’s also vital to know exactly what they are likely to do – if anything – to protect their own interests.

How do you manage stakeholder risk?

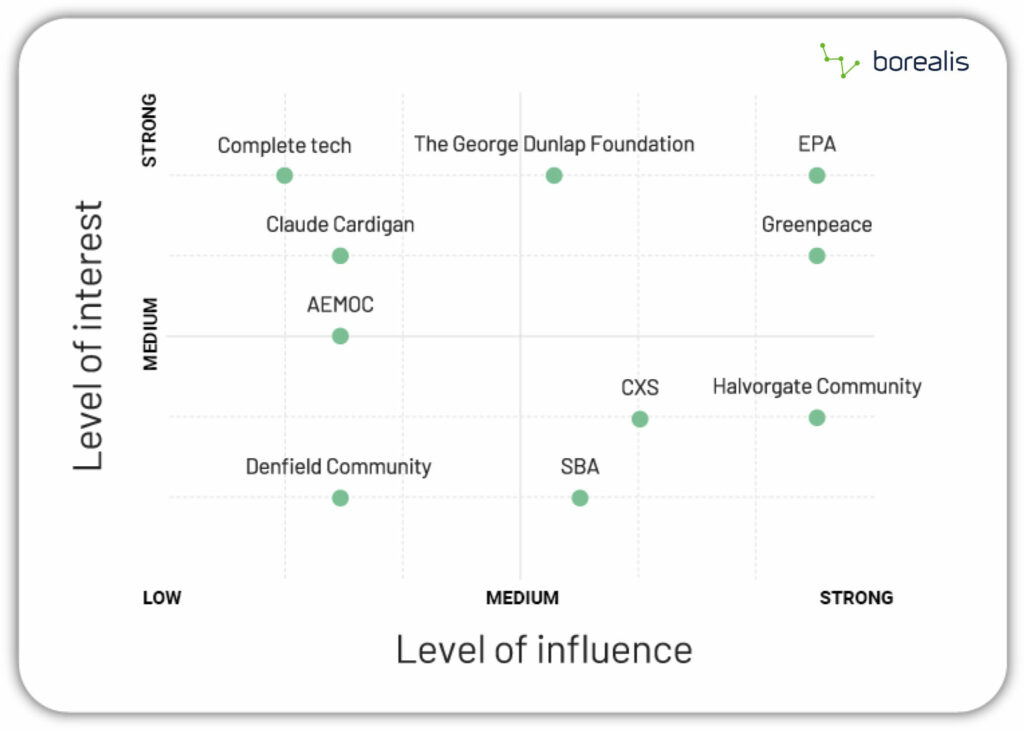

The first step in risk management is mapping stakeholders. This entails identifying, analyzing and prioritizing stakeholders according to their level of interest in and influence over a project. This process gives project managers vital information about the existing stakeholder landscape and how it should be best navigated.

Stakeholder mapping is an ongoing process. As project stakeholders come and go, change opinion and gain/lose influence, teams will need to adapt their stakeholder engagement strategy. This is the only way to ensure it remains effective over time.

Importance of identifying stakeholders early in the project

Identifying and analyzing stakeholders early in a project is crucial, as the entire stakeholder management strategy should be solidly based on this analysis. Among other things, it tells you which stakeholder groups need to be engaged at which stages of the project. It also tells you each group’s preferred means and frequency of communication, along with what message needs to be conveyed to each group.

Some stakeholders, like investors, regulators and management, may need to be involved in the project’s early pre-planning phase. Knowing how to manage the risks associated with these stakeholders will be important right from day one.

Difficult stakeholders, who may exhibit indifference, passive-aggressiveness, or open hostility. Whether those challenges stem from poor information, outside influence, previous bad experiences, or resistance to change, it’s important to identify them early.

Keep in mind that early stakeholder engagement fosters a sense of ownership and collaboration. This will increase the chances of project success, as stakeholders are more likely to support and advocate for initiatives in which they feel involved and valued from the beginning.

6 main steps of stakeholder risk management

Stakeholder risk management can be broken down into six main steps, which are carried out in a continuous loop:

- Identify risks

- Map stakeholders

- Plan strategy

- Engage stakeholders

- Measure progress

- Adjust strategy

Want to know more? See the best management methodology for stakeholder engagement and risk management.

Steps in developing a stakeholder risk management strategy

1. Determine the severity of risks

2. Develop a plan for mitigating the risks

3. Communicate the risk

4. Monitor the effectiveness of your plan

5. Assess and adjust the strategy

Impacts of poor stakeholder risk management

Failing to manage stakeholder risk can open the door to all sorts of problems, such as conflicts, project delays and employee turnover. In some cases, it can even lead to fines, lack of stakeholder acceptance, and project failure.

With the omnipresence of social media and mobile phones, stakeholders have the tools to monitor, record and share information globally about your project at lightning speed. It is incumbent for the owner of the project to also own the conversation that surrounds it.

3 Top Reasons Projects Fail

- Failure to communicate

- Failure to engage stakeholders

- Failure to address cultural change

– Calleum Consulting “Why do projects fail” 2015

Tools for stakeholder risk management

Specialized software to manage stakeholder risk

Specialized stakeholder relationship management software can be used to manage stakeholder risk more effectively. It centralizes all stakeholder data, engagement activities and compliance requirements, making this information easy to find, share, track, update and report. Powerful stakeholder mapping and stakeholder analysis features make it easier to prioritize stakeholders and target engagement efforts with greater precision.

Overall, stakeholder relationship management software leads to better outcomes with much less effort. It also creates a powerful corporate memory to streamline the efforts of future projects by creating an ever-growing stakeholder database and repository of lessons learned. Centralizing data and making it accessible across multiple departments also helps to break down silos which can hinder the timely flow of important information.

Grievance mechanisms

Certain sectors are obliged to implement issue and grievance handling mechanisms to comply with IFC and other lender requirements. That said, all sectors can benefit from adding these mechanisms to their risk management approach. Implementing a mechanism for handling community grievances or complaints will make it much easier to prevent, mitigate and resolve possible conflicts with stakeholders in a timely manner.

Putting a transparent and systematic mechanism in place also demonstrates to local communities a sense of accountability and a willingness to listen. This can help dismantle a key stumbling block to creating that climate of trust that’s so vital to productive community relationships. Implementing a tool such as a grievance portal that lets you anonymously collect grievances from whistleblowers and community members and other stakeholders can be particularly helpful.

A community complaints and issue management tool can serve as an early warning system for identifying and understanding stakeholder concerns that could, if left unaddressed, pose a risk to a project’s successful completion. These risks can range from damage to corporate reputation to project disruption or even outright closure.

For a broader look at the guidelines for developing an effective grievance management mechanism, check out our blog on grievance management mechanisms. Or access the CAE’s Grievance Mechanism Toolkit.

How to prevent grievances from evolving into crises

Any project, big or small, has the potential to create disruptions or discomforts for surrounding populations.

See how you can prevent potential crises by managing grievances more effectively.

When poor risk management affects stakeholders

Effective risk communication strategies

Communicating efficiently, transparently and meaningfully with stakeholders is a great way to mitigate stakeholder risks. 92% of CEOs agree that communicating information about risk is critical to a project’s long-term success.

Teams that are committed to communicating risk to stakeholders also recognize that potential issues must be identified beforehand. This foresight better equips teams to address arising issues with thoughtful problem-solving, rather than with ill-prepared confusion.

Stakeholder software will make it easier to detect, visualize and report potential risks based on a range of criteria, whether it’s by stakeholder group, project phase, or geographic location.

- It demonstrates and promotes accountability.

- It helps to set more realistic stakeholder expectations.

- It ensures your entire team is on the same page.

Best practices for persuasive risk communication with stakeholders

Over time, teams inevitably get to know their specific stakeholder groups and how to effectively communicate with them. But these best practices will apply in all situations.

Understand your audience

Be clear and concise

Be honest and transparent

Use visual aids

Highlight actions and solutions

Engage in two-way communication

Provide a comparative perspective

Use credible sources

Avoid overloading information

Review and test messages

Maintain consistency

Update regularly

Dive deeper: Read our article on How to Communicate with Stakeholders Effectively.

Stakeholder risk management – Industry-specific examples

Managing social risk in mining and oil & gas

In large infrastructure projects, such as those found in the mining industry, social license to operate is still the biggest risk that companies face. Missteps of any kind can jeopardize access to capital or even lead to a total loss of social license to operate.

Mexico’s Energy Reform

Back in 2013, Mexico allowed private investors to bid on oil, natural gas, shale, deep/shallow-water, and other possible energy reserves for the first time, ending a 50+ year monopoly by the state-owned oil company Petróleos Mexicanos (Pemex). Pemex’s inability to keep up with technological change was one of the driving forces behind this Mexican energy reform.

Despite the estimated 100+ billion barrels of underground oil and natural gas ripe for development, the first bid did not go as well as the Mexican government had hoped. This was due to a number of reasons:

- The exploitation of fracking wells was a massive challenge in this arid region of Mexico, where infrastructure was underdeveloped and water scare.

- The presence of drug cartels represented considerable safety risks.

- To achieve an acceptable ROI on their investment, companies would need to conduct proper social and environmental baselines and impact assessments, collaborate with local partners who understood Mexico’s reality and who wielded a certain amount of political clout.

- Since shale gas projects always come with resistance from local communities, meeting demands such as opportunities for employment would be key to gaining both access to land and social

Read our article on understanding Key Stakeholders in the Oil & Gas Industry >

Managing social risk in transportation

The COVID-19 pandemic all but reshaped the transportation industry overnight. It also added a whole new layer of social risk for this sector. Even when viewed from a “business-as-usual” perspective, the social risks in transportation run the gamut:

- Greater regulatory oversight

- Cyberattacks on physical assets

- Advancing technology

- Ongoing driver shortage

- Deteriorating infrastructure

- Demand volatility

Failing to address the social implications of these risks on customers, employees and local communities, as well as on the organization itself, can lead to all sorts of difficulties that can put transportation projects – and the agencies behind them – in hot water.

Read our article on identifying and Understanding Stakeholders in Public Transportation >

Managing social risk in energy

Over the decades, the energy sector has made significant strides in managing social risks. Among these efforts:

- Addressing negative public perception to protect reputation and access to investors

- Ensuring site security amid a rise in terrorist acts

- Complying with a growing regulatory burden

- Minimizing the health and environmental impacts of the pollution created through power generation

- Controlling pricing in the face of climate change

That said, a lack of crisis preparedness can devastate an industry. In Australia, which has been crippled by a prolonged energy crisis, stakeholder relationships have been greatly strained.

Read our article on Understanding Stakeholders in the Energy and Public Utilities Sector>

Managing risk in telecom

As 5G wireless technology spreads globally, so does the conversation surrounding its potential risks. While 5G promises significantly greater performance than previous generations, as well as economic benefits, two key concerns are dampening the hype around 5G technology. These concerns are worth addressing when communicating with stakeholders:

- Public health: The health effects of radiofrequency (RF) radiation are still under dispute. Companies will need to stay up to take on applicable safety codes and regulations on RF energy.

- Security breaches: The software and firmware of 5G-compatible devices from Chinese manufacturer Huawei have been associated with serious security breaches. Combined with the fact that Chinese law requires companies to cooperate with national intelligence services, the risk of possible Chinese government espionage through these compromised devices is being taken very seriously. Some countries have banned Huawei from their networks entirely; others have granted it only partial access to networks. To minimize their exposure to such security risks, telecom companies will need to select vendors with care and avoid relying on a single vendor.

Any project that involves constructing, maintaining or exploiting assets needs to keep its stakeholders in mind at all times to ensure their continued support.

Tool for stakeholder engagement and stakeholder risk management

Borealis stakeholder management software goes beyond the functionalities of simple risk management tools to provide a 360 degree view of your project’s stakeholder landscape – including all associated risks. It enables teams to work with data that’s more complete, more reliable and more easily accessible. It improves day-to-day efforts and overall decision-making, resulting in better project outcomes.

Key takeaways

- All projects entail risks that need to be managed early and proactively to ensure successful outcomes

- Developing a solid stakeholder risk management strategy according to best practices is essential

- Stakeholder management software will centralize all stakeholder data and engagement activities, eliminating the risk of oversights, overlaps or inconsistent messaging that can undermine your stakeholder risk management strategy

Get started with Borealis software. Talk to an expert >